You wouldn’t let a stranger take a picture of your credit card, would you? Or leave it lying on a restaurant table for anyone to grab? Of course not! You  work hard for your money, and you don’t just want to give it away!

work hard for your money, and you don’t just want to give it away!

It seems to be a basic instinct to protect your credit card information when it comes to physically carrying and using your cards. What about online usage makes that any different? If anything, you should be even more wary with online usage of your credit cards.

Although it’s disappointing, the odds are that you’ll have to replace your card at some point due to fraudulent activity. This could be something as widespread as the Target server hacking which led to millions of fraudulent charges, or something as small as entering your account information through a medium you thought would be safe.

If you have a nice bank, they might even call you before canceling your card to save you some embarrassment during check-out! If not – well, I’ve been there. Hopefully you have cash on you or you have more than fumes in your gas tank!

What can you do to lessen the chance of having your information stolen?

1. Only enter your information onto secure sites.

2. Unless you are confident in the company and the individual you are speaking with, don’t give your information over the phone.

3. Run virus and malware detectors frequently on your computer to confirm that no one is tracking your keystrokes or activity.

4. Shred any documents involving sensitive information, or better yet, receive online statements as much as possible.

5. Check your bank statements often and report any false charges immediately.

6. Join a credit tracking website, such as Experian, to track any new cards or services opened with your information.

How do I know if a site is secure?

Website owners want you to be aware how secure their sites are, so they make this information as visible as possible without becoming a distraction. If you look at the beginning of a url, secure sites will begin with “https://.” The website should also have a clickable lock feature in the status bar of the browser. Clicking on that lock button will show more details of the site’s security; it is not just a picture! Some sites will also include security information in the footer of their website, though a lack of this doesn’t necessarily mean the site is unsafe.

“Can’t I just email you my card information?”

No! Please, please, please do not email me or anyone else your credit card information. Ever. Emails are compromised all the time! I currently have three people in my Dakno email alone trying to get my information so that I can claim the money left to me from Prince Solomon of Egypt in his last will and testament. All it takes is entering your email password in one wrong place, and then hackers can have access to any email you’ve ever sent or received with any sensitive information they may contain. Don’t believe me? Check your spam and junk folders.

What does Dakno do to keep your information safe?

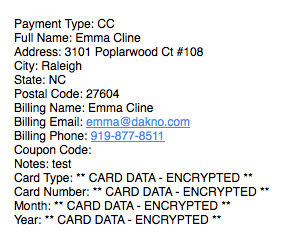

Dakno has a secure payment portal that encrypts all information entered so that only I may see it. That means that I have to enter a password every single time I want to view credit card numbers, and no one outside of those involved in billing will be able to access that information.

Need to update your card information? Put it in the payment portal! Buying a new product? Put your information in the payment portal. Uncomfortable with the payment portal? I promise that it’s safe, but give me a call and I’ll put it in our software myself! Again, only I have the ability to view your information from the payment portal and enter it into our software, and if I didn’t do so securely, I’d be out of a job!

“I got my new card, so I’m done, right?” Wrong!

It can be a major pain to have your bank change your credit card number due to fraudulent activity, but the likelihood of it occurring decreases drastically when you are protective of your information. If this does happen to you, please make sure to notify any company that automatically charges your card on file. Otherwise, it could lead to late fees, cancellation of your accounts, or could in some cases affect your credit score.

If you have a credit card fraud story to share, be sure to let us know in the comments below. I’ve been stranded with an empty gas tank and a frozen credit card, so I feel your pain!

Emma